Something has to be done to combat climate change. A Carbon Tax might be part of the solution.

The USA is currently releasing 14.7 trillion pounds, or around 6,673 million metric tons, of CO2e annually.

These emissions are largely a result of the burning of fossil fuels to generate energy. During the Paris Climate Agreement, our country pledged to reduce those emissions and do our part in keeping the global temperature rise below 2ºC. This pledge set benchmarks of a 17% reduction by 2020 and 83% before 2050. But according to the 2015 Annual Energy Outlook by the EIA, future U.S. energy use – and GHG emmisions – are only going to increase .

This leaves us with a problem.

Although simply enforcing the regulations permitted by the Clean Air Act of 1973 could be enough to get us down 17% by 2020, it will not be enough to ever reduce emissions by 83%.

Simply put, the current predictions of US energy use – if our patterns continue undisturbed – are starkly incompatible with our country’s reduction goals. As the World Resource Institute states, “Without new action by the U.S. Administration, GHG emissions will increase…” instead the decline imperative to stay below the benchmark.

New legislation of some kind must be implemented for our country to meet our GHG reduction goals.

The most promising solution to this problem might be Carbon Pricing – putting an economic tag on the CO2 emissions produced by industry and consumers. One way to do this would be through a Carbon Tax.

A Carbon tax would put a tax on the use of fossil fuels, similar to the tax on tobacco products. This tax would increase the price of fossil fuels – raising the cost closer to their actual economic value – effectively making more expensive alternative energy sources cost competitive. The goal would be to reduce fossil fuel popularity by eliminating one of their major allures – namely their inexpensiveness. Once fossil fuels ceased to be significantly cheaper than their “green” competitors, the market would inevitably switch from the destructive burning of fossil fuels to the much more sustainable use of renewable energy. Since burning less fossil fuels equals less GHG emissions, a functional Carbon Tax would be good news for policy and our planet.

The mechanics of a Carbon Tax are very simple.

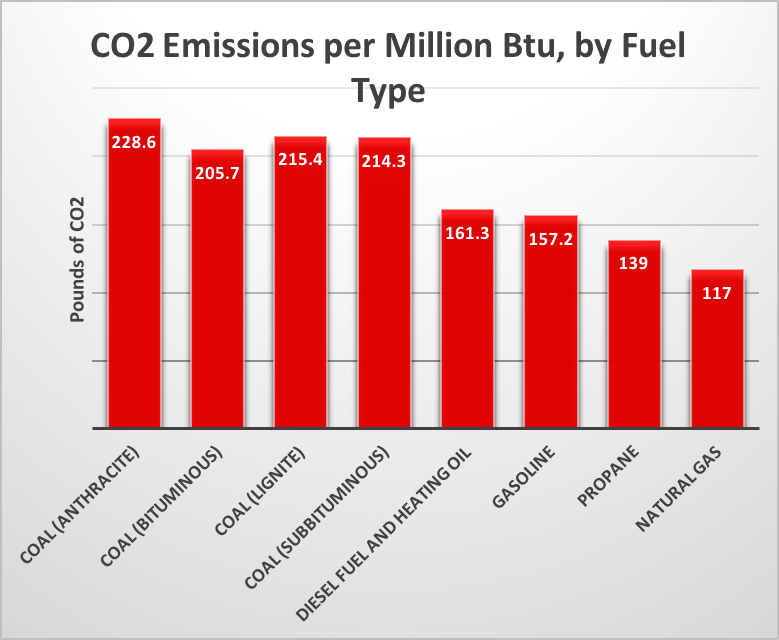

It is a form of a pollution tax and is based on the CO2e released during the combustion (burning) of the fuel. Since different fossil fuels have different chemical properties, the tax would not be the same for all fossil fuels. Instead, specific taxation for each fuel would be derived from the ratio of the useful energy it produces to the amount of CO2e emitted (in tonnes) when burned. As such, coal would be taxed more heavily than natural gas since it is a less efficient fuel source (see chart below).

image from http://www.carbontax.org/

The Carbon Tax has a lot of support, especially within the public sector, with entire non-profits dedicated to its enactment. And there is good reason for their enthusiasm.

As Jeffrey D. Sachs, director of the Earth Institute at Columbia University says, “A straightforward carbon tax has vast advantages.” A carbon tax would be clear, predictable, and quantifiable, based on actual GHG emissions instead of the complex political dance of a Cap-and Trade program. It is also applicable to international fossil fuel trade as Charles Komanoff, co-director of the Carbon Tax Center explains – “Carbon-taxing nations can easily offset import price differences [of fossil fuels] with a ‘border tax adjustment.'”

There are many who are discouraged or even enraged by the word “tax”, but the part that most anti-tax spokes persons forget is that taxes don’t just make money disappear – they simply move it from one sector and apply it to another.

A well designed Carbon Tax could divert money away from the fossil fuel industry and towards R&D for sustainable energy or even towards a rebate to the public – all while decreasing GHG emissions.

While a Carbon Tax would not necessarily be the one-size-fits all solution to Climate Change and US Emission Reduction Commitments, it would certainly be a step in the right direction.

Want to learn more about Carbon Taxation? Click here

Want to learn about Cap-and-Trade Carbon Pricing? Click here

Part 5 in a series on sustainability definitions. Click here to read other posts in this series.