Agenda for Monday, Oct. 8

–Context!

–Common Errors

Context #1

Add the Quick Facts for city population, demographics.

Little Rock: African American comprise 42 percent of Little Rock’s population. https://www.census.gov/quickfacts/fact/table/littlerockcityarkansas,US/PST045217

Add typical salary from Occupational Employment Statistics database for Arkansas

https://www.bls.gov/oes/current/oes_ar.htm

Common Errors – Math

Percent vs Percentage Point

At Lyon College, 67 percent of non-first-generation students paid back their loans within five years, while only 53 percent of first-generation students did the same, which results in a 14 percent POINT difference. The median debt for both types of students was the same though, at $12,000.

You mean “percentage point.” 14 percent of 67 is 9.4.

Steve Doig – MathCrib-Doig

Common Errors – AP Style on Numbers

AP Style on Numerals:

Numerals – AP Stylebook-2avrxtn

Common Error – Divi Library

Divi Builder. Do Not Save to Library.

Context #2: Build Charts for Context

First row: The overall median debt for Arkansas students; for men, for women.

Second row: The overall median debt for first generation students. And non-first generation

Third row: The overall statewide repayment rate, and the rate for men, for women

Fourth row: The overall median debt for white, black, asian, hispanic

Post on WordPress with the category Context

Research – Data Question

The Financial Aid department does not report loan repayment info to the Department of Education. “Once the students leave us we don’t track their information anymore,” he said.

Question: Look at data dictionary for source of this information. All 1,826 columns explained here.

https://collegescorecard.ed.gov/assets/FullDataDocumentation.pdf

https://collegescorecard.ed.gov/assets/CollegeScorecardDataDictionary.xlsx

Homework

#1: Read this report and compare to your work on context. Prepare to discuss it Wednesday

https://ticas.org/sites/default/files/pub_files/classof2016.pdf

#2: By 11:59 p.m. Tuesday, fix the issues with your charts and stories from Assignment #2. Post on WordPress, use the Context category for a tag

Logan Morales, Bartender. By Elisabeth Butler. – Revised

Version 2

(good framing and lighting but the image seems a bit blurry. check the original and re-upload)

FAYETTEVILLE, Ark. – For some people, low income jobs end after college. But for some, they remain for years after graduation. This is the case for Logan Morales.

In 2014, Logan Morales began her career as a server at Grub’s Uptown in Fayetteville. She was a sophomore at the University of Arkansas studying criminal justice. When Morales moved to college with her high-school sweetheart Alan, her parents said they would cut her off if she moved in with him. In the fall of her sophomore year, she did just that.

Morales tried to have a college experience regardless. She was a member of Phi Mu sorority, lived in an apartment, and was getting an education all at the same time. In order to pay her sorority dues rent, and tuition, Morales started to pick up every shift she could to make her payments. She succeeded, and finished college paying for nearly everything on her own.

Morales graduated from college in 2016, and failed to find a job right away. She currently remains employed at Grub’s, as a server and bartender making probably minimum wage, but in a very inconsistent way.

“There is a lot of unexpectedness” when it comes to serving Morales says. Some days you leave with $300, which in some cases is the amount of your car payment, and some days you leave with $19 which barely covers lunch.

In October 2017, the Morales’ got married. Something they paid for entirely themselves, with minimal help from her parents.

Between paying her sorority dues and paying for the big day, Morales learned very important lessons in budgeting.

(audio quality is solid. Please add an introduction and edit this so it isn’t as repetitive.)

Beyond budgeting, Morales learned certain lessons in being server that make it easier to make ends meet.

“You can work however much or little you want,” she said.

Finding “regulars”, or as she calls them “regs” is important too. Morales talks about the importance of finding people who come in often, tip well, and get to know you so they tip better. Throughout most of the fall, she has a group of Ducks Unlimited members come in every Tuesday night. They ask to sit with her, and leave her close to $100 each time they come in.

Most serving jobs release a work schedule, and then allow the servers to give up or pick up shifts. The more you work, the more money you make.

But beyond the financial hardships of serving, she talked about the physical ones. Being a server, she says, means working double shifts to make more money. For most doubles, this usually means open to close, which at Grub’s is 10 p.m. – 11 p.m. That is thirteen hours on your feet, running around, and actively engaging with customers.

Being a bartender adds an entirely new set of challenges. Often, happy hour for some customer lasts longer than an hour, and ends in an Uber home because they got their keys taken away. There is also a need to know the regulations of Alcoholic Beverage Control to avoid getting a ticket or fine by the agency.

For Morales, serving paid off some of the most important times in her life. Her tips paid for her sorority dues, her first home with her boyfriend, and eventually her wedding. Living on a servers’ wage is possible, it often takes more than just your scheduled shifts to do so.

________________________________________________________________________

Version 1

(good framing and lighting but the image seems a bit blurry. check the original and re-upload)

FAYETTEVILLE, Ark. – For some people, low income jobs end after college. But for some, they remain for years after graduation. This is the case for Logan Morales.

In 2014, Logan Morales began her career as a server at Grub’s Uptown in Fayetteville. She was a sophomore at the University of Arkansas studying criminal justice. When Morales moved to college with her high-school sweetheart Alan, her parents said they would cut her off if she moved in with him. In the fall of her sophomore year, she did just that.

Morales tried to have a college experience regardless. She was a member of Phi Mu sorority, lived in an apartment, and was getting an education all at the same time. In order to pay her sorority dues rent, and tuition, Morales started to pick up every shift she could to make her payments. She succeeded, and finished college paying for nearly everything on her own.

Morales graduated from college in 2016, and failed to find a job right away. She currently remains employed at Grub’s, as a server and bartender making probably minimum wage, but in a very inconsistent way.

“There is a lot of unexpectedness” when it comes to serving Morales says. Some days you leave with $300, which in some cases is the amount of your car payment, and some days you leave with $19 which barely covers lunch.

In October 2017, the Morales’ got married. Something they paid for entirely themselves, with minimal help from her parents.

Between paying her sorority dues and paying for the big day, Morales learned very important lessons in budgeting.

(audio quality is solid. Please add an introduction and edit this so it isn’t as repetitive.)

Beyond budgeting, Morales learned certain lessons in being server that make it easier to make ends meet.

“You can work however much or little you want,” she said.

Finding “regulars”, or as she calls them “regs” is important too. Morales talks about the importance of finding people who come in often, tip well, and get to know you so they tip better. Throughout most of the fall, she has a group of Ducks Unlimited members come in every Tuesday night. They ask to sit with her, and leave her close to $100 each time they come in.

Most serving jobs release a work schedule, and then allow the servers to give up or pick up shifts. The more you work, the more money you make.

But beyond the financial hardships of serving, she talked about the physical ones. Being a server, she says, means working double shifts to make more money. For most doubles, this usually means open to close, which at Grub’s is 10 p.m. – 11 p.m. That is thirteen hours on your feet, running around, and actively engaging with customers.

Being a bartender adds an entirely new set of challenges. Often, happy hour for some customer lasts longer than an hour, and ends in an Uber home because they got their keys taken away. There is also a need to know the regulations of Alcoholic Beverage Control to avoid getting a ticket or fine by the agency.

For Morales, serving paid off some of the most important times in her life. Her tips paid for her sorority dues, her first home with her boyfriend, and eventually her wedding. Living on a servers’ wage is possible, it often takes more than just your scheduled shifts to do so.

Tonney Gazaway, Custodian. By Andrew Epperson

Like Quintero, other individuals in Northwest Arkansas think education is the key to a successful monetary compensation. One man goes to the UofA University of Arkansas everyday, but his ventures to classrooms typically involve emptying trash cans and mopping floors. He hopes to one day learn in those same classrooms.

Tonney Gazaway, 25, is a custodian at the university and works in the J.B. Hunt building on campus. He’s been serving in that capacity for a little over a month after he was fired from his job at the Fayetteville Public Library. He said he and another worker were employed part time, but his boss decided to terminate his contract in order to hire his coworker full time.

He said he was out of a job for about a month, and supporting his wife and daughter became a difficult task.

(profanity at 18, 42. edit)

Gazaway declined to disclose his exact salary, but he said the job as a janitor set him up for a 401(k) savings account, which was an opportunity he lacked in his prior jobs. He is a native of Starkville, Mississippi and moved to Fayetteville when his wife got a job at the alumni association.

Though he understands most people wouldn’t ever dream of being a custodian, he said he’s happy to be working in a “laid-back environment.” Still, checks are paid out every two months, and his family is just now starting to get back on track money-wise.

In the future, Gazaway hopes to enroll at the university and earn a degree, he said.

“I want to get into video game design,” Gazaway said. “I’ll work for any company. I know I’ve gotta get through some classes I don’t wanna take. But that’s what it takes to make it. You’ve gotta do things you don’t wanna do. That’s what I’m doing now.

Some workers, including custodians, get a 90-percent discount on tuition, Gazaway said. Because of this, he hopes to enroll in Fall 2019 after saving up his resources for a while.

Test Layout

WORKING, AND POOR, IN ARKANSAS

THIS IS A DRAFT.

NOT FOR PUBLICATION.

CONCEPT DESIGN ONLY

Nicholas Pando, Gaming and Real Estate. By Mary Kerr Winters

FAYETTEVILLE, Ark. – With an eye for gaming and an aspiration to sell homes, Nicholas Pando, 22, makes a living and finds community working two minimum wage jobs at a video game store and at a real estate firm.

Pando has dedicated his time entirely to work, spending more than 40 hours a week. He is paid Arkansas minimum wage of $8.50 an hour for both jobs. “I am my grandma’s assistant at Lindsey Real Estate, so whenever she needs me to go and sort paperwork, I will go and work there,” Pando said. Pando said he has flexible hours at Dragon’s Keep, which sells video games and comics, making it easier to have two jobs at once. Pando said he definitely classifies himself in the lower class, and “on some days upper lower class.”

Pando lives with his mother and the rest of his younger siblings in Springdale, Arkansas. Although he is not paying rent, Pando said “he pays for his own insurance, phone bill, and car.” He said, “living the way that I live, I would not be able to pay my own rent right now. With the expenses and student loans I have to pay off, it would not be possible.”

“Working at Dragon’s Keep has been one of the greatest ways to have community,” Pando said. “Between working here and playing here you see and meet a lot of people.” The community at Dragon’s Keep is the reason why he landed a job at the store. The people who come in to play community game sessions are from a large spectrum of different annual incomes. Pando said, “It’s more based on people like the game then their income.”

One of his responsibilities at Dragon’s Keep is to take care of the many cats that roam around the store. Pando laughs when he said, “other than shop keeping, someone has to take care of the cats.”

His favorite game is “Magic,” even though he has played games like Pokémon competitively. His biggest goal right now is to pass his real estate exams to eventually become an agent. All he said he can do in the time being is to “take it one step at a time.” Pando believes, “It is best to make the most of what money you have just because there is always something you are missing.”

Class 12, April 12

Joe Martin Stage Race – Finish on Mount Sequoyah

Literature of Journalism course for the Fall 2018.

Hi all – see the details about the Literature of Journalism course for the Fall 2018.

This is a great class taught by Prof. Bret Schulte. The graduate section is Literature of Journalism, JOUR 5313 and the undergrad section is JOUR 405V-006. There’s also an Honors Colloquium section, JOUR 3932H.

The course operates something like a book club, one devoted to works of long-form journalism. We read a book over the course of two weeks, discussing themes/structure/tone/voice/character development/reportage along the way. After each book, the student writes a response blog and then a paper at the end of the semester. Grad students also do a mid-term.

Here’s the course description:

A survey of book-length narrative nonfiction from mid-20th Century to today. Authors may include pioneering literary journalists, such as Hersey and Capote; New Journalists, such as Didion and Wolfe; and their successors, such as Frazier and Orlean.

Questions: bjschult@uark.edu

Agenda:

5 pm: Selection Final Graphics. Design. Writing the wrap-up. Homework

5:30 pm: Bobby Ampezzan

6:15 pm: R Studio, join race and income data

Design:

WordPress Developers Here Next Week

Copy this code and send it to your cellphone. View page. Comment.

(https://wordpressua.uark.edu/datareporting/working-and-poor-in-arkansas/)

All right. I think I’ve looked at all of the profiles and listened to the audio bars available.

Bobby Ampezzan

More Tips from Ampezzan

Fact Check

Attached is a spreadsheet for the fact checking process. Please put the name, email and phone number of the people you spoke to on this list. I will be contacting them and sending a few quotes to make sure everything is ok. I do this on major projects and rarely have any issues – the people we interview really appreciate the follow-up.

Editing Punch List

Photo editing: Crop and Adjust Brightness….

Need graphics for the various occupations:

–Fast food manager — Aubry

–Waitress – Serrano

–Retail sales — Mary Kerr

–Manager Fast Food — Serrano

–Retail Store clerk — Ann Johnson

–Child care — Elisabeth

–Bar Musician — Andrew

–Barber – Aubry

–Custodian – Andrew

–Personal care assistant – Ann Johnson

Mary Kerr Winters

Modify this to make it just an interactive Tableau map that we will use in the gallery.

–bring in the audio files, fix audio for Cathy Lee

Andrew Epperson and Philip Sais audio.

–Question for Epperson on the Sais graphic – bar musicians

–re-edit the photo and crop it tighter

Ann Johnson, Chris Paff

–edit graphic, eliminate legend – measure names.

–update data for 2017.

Katie Serrano

1) Dana Ralpho

–Wage she earns at Wendy’s

–Audio clip

–More detail about her situation. This story is very brief and incomplete

2) Renee Smith

–increase in pay reference – what was that? explain

–Audio still doesn’t work.

–Photo needs cropping

–Fix graphic. Just display average annual wage

Elisabeth Butler

Poverty by Race in Arkansas: Elisabeth Butler

Redo this to focus just on Arkansas

(https://bpb-us-e1.wpmucdn.com/wordpressua.uark.edu/dist/0/367/files/2018/02/Demographics-and-Poverty-1ebo4l8.jpg)

–Abigail Jobst: Not sure where she is working (Grubs?), how much she making and if they remain in poverty status if Zeballos is back to work making $50,000?

TASKS TO DO

Definition of Working Poor

See “Table Notes” to far right on factfinder website after you’ve generated a table.

Read: “Poverty Status in the Past 12 Months”

“Poverty Status of Households”

Definitions. working Poor

–Poverty thresholds:

The actual poverty thresholds vary with the makeup of the family. In 2015, the weighted average poverty threshold for a family of four was $24,257; for a family of nine or more people, the threshold was $49,177; and for one person (see Unrelated individuals), it was $12,082. Poverty thresholds are updated each year to reflect changes in the Consumer Price Index for All Urban Consumers (CPI-U). Thresholds do not vary geographically. (For more information, see “Income and poverty in the United States: 2015.”)

https://www.bls.gov/opub/reports/working-poor/2015/home.htm#unrelatedindividual

Weighted Average Poverty

Thresholds in 2015 by Size of

Family

(Dollars)

One person 12,082

Two people 15,391

Three people 18,871

Four people 24,257

Five people 28,741

Six people 32,542

Seven people 36,998

Eight people 41,029

Nine people or more 49,177

Source: U.S. Census Bureau.

https://www.census.gov/content/dam/Census/library/publications/2016/demo/p60-256.pdf

Graphics Comments from Jon Schleuss

These are a really great start!

Return of R Studio

Exercise: Join Race and Income Data

April 12 race-income exercise-2k0qnde

Data

US Ark Counties Poverty ACS_16_5YR_DP03-Jan 24-y46vv7

Race Poverty Set

ACS_16_5YR_S1701_april12-22nnfd5

File Header Definitions

Homework, due 11:59 pm Wednesday April 17:

-Revisions to Assignment #4

-Editing punch list.

-Overview essay: 400-500 words

Last week we discussed the major themes that emerged from our reporting. Write an overview story that would stitch together the material we have and incorporate these themes.Draw from the class readings. Feel free to use material from your colleagues’ work – just give them a reporting credit in your essay. The final overview essay will take from a number of the profiles.

Here is some guidance for the essay. You don’t have to hit all of these themes but this may help you organize your thoughts.

In our initial interviews, many participants reflected these sentiments:

–Never complaining

–Pride

–Acceptance

–Contentment

–Positive

One other theme: We found many of these people had money available for cable tv, entertainment, video games.

We also talked to a number of women, some of whom were supporting their families with low-wage jobs.

Are these people working poor? Describe the working poor definition and how these people do or do not fit in.

Your essays will be distributed next week for peer evaluating and grading. The best one becomes the lead byline for the overview story.

DRAFT PROFILES

Graphics for Final Project

Poverty by Race in Arkansas: Elisabeth Butler

Redo this to focus just on Arkansas

Working Poor in Arkansas – Elisabeth Butler

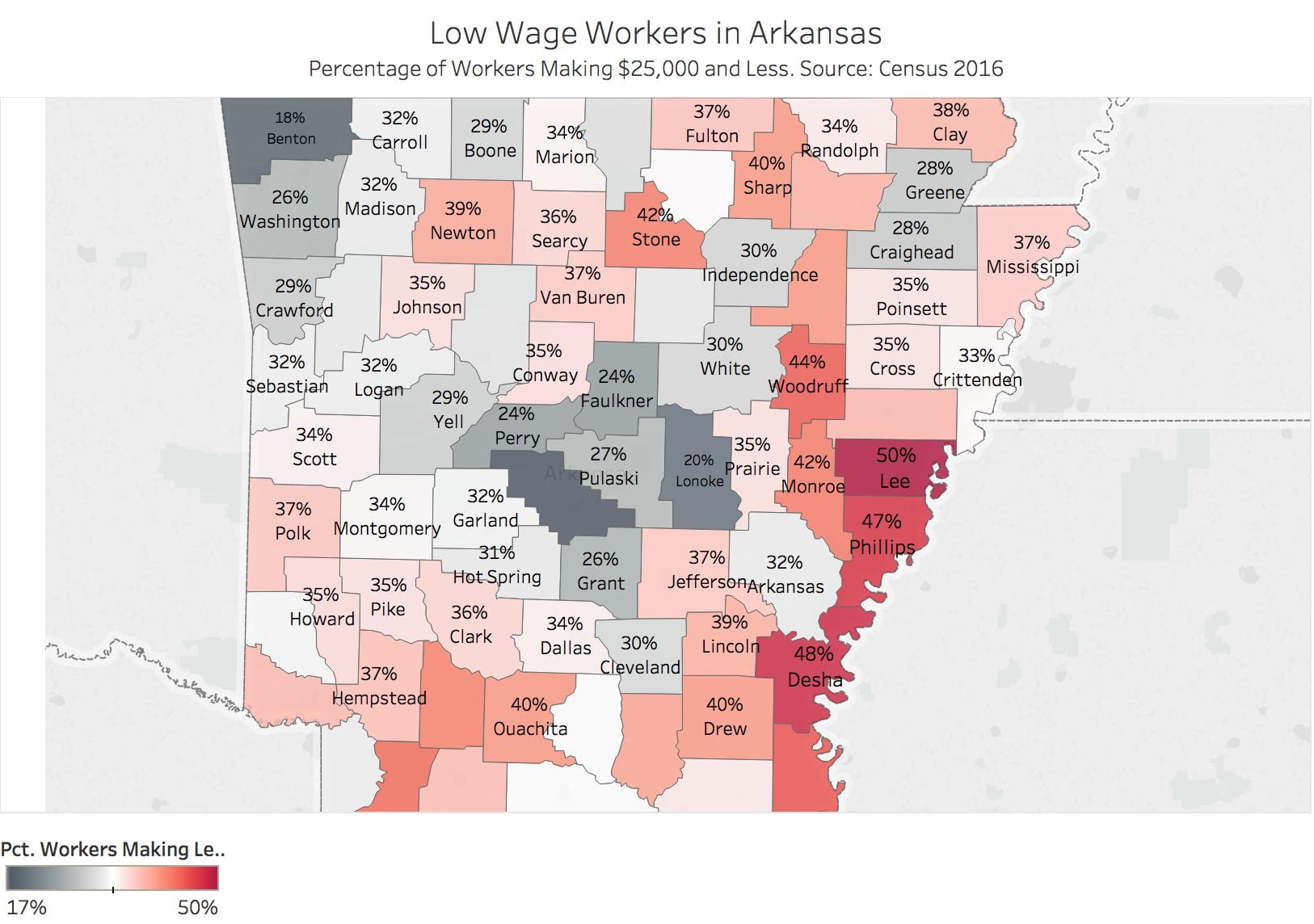

Working Poor Map for Arkansas: Mary Kerr Winters

Single Mother Poverty: Andrew Epperson

Younger Worker Poverty: Katie Serrano

Fast Food Worker Wages: Katie Serrano

Waiter and Waitress Wages: Katie Serrano

Living Expenses for Working Poor: Katie Serrano

Percent Employed in Poverty: Ann Claire Johnson

Material all from this mega post:

https://wordpressua.uark.edu/datareporting/?p=7246&preview=true

Joy Senn, Eureka Pizza. By Ann Claire Johnson

FAYETTEVILLE, Ark.- Joy Senn, 22, raised in rural Eldorado, Arkansas, works at Eureka Pizza on Leverett Avenue in Fayetteville, Arkansas. Senn is currently on a “financial break” from being a student at the University of Arkansas. Senn has two semesters left of school in order to obtain a degree in biology. She is currently not enrolled in college. She works the night shifts at Eureka Pizza to “maintain her full time status”at Eureka Pizza even though she also works during the day at Smitty’s Garage as a waitress. Senn has been financially independent since she began college. She pays for her tuition, her rent, and she pays for all of her bills without help from family, friends, or sponsors.

Working at the night shift can be crazy any day of the week, but on weekends Eureka stays busy until their weekend closing time, 3 am. “Our main people that we get coming in late at night are college kids, or people coming from the bars,” Senn said. Since starting her job at Eureka pizza in November, Joy Senn has had her hourly wage raised from $8.50 to $8.75. Working throughout college at different food service industries is very different than Senn’s job on a farm in Eldorado.

Eureka Pizza takes care of their employees, she said. Senn said that the employees, like herself, who are under the poverty line, get benefits for working full time. “If you are a full-time employee, you get paid vacations, paid holidays, and time and a half after you have worked overtime,” Senn said. Although the employees that fall below the poverty belt struggle to make ends meet, the pizza restaurant really works with their employees, especially the ones with families, to make sure that they are able to maintain their “full-time status.”

Since working at Eureka Pizza Senn has experienced out-of-control customers. “Occasionally we have customers that we have to call the cops on if they’re belligerently drunk,” Senn said. Her position at the pizza restaurant is classified as a cook but “it’s kind of like an all around restaurant. We all take the orders, we all make the dough, we all have to close the restaurant down at some point or another,” Senn said. Senn is currently living near the University of Arkansas campus with a roommate that she found on the university’s “roommate surf” website. Neither she nor her roommate depend on each other for living expenses.

Senn had an academic scholarship when she first began college but was unable to keep it because of her workload on top of schoolwork.

Mishell Quintero, JC Penneys, By Andrew Epperson

A number of employed individuals in Northwest Arkansas still struggle with money. One Springdale resident not only deals with that problem, but also finds it challenging to see a way out because of her status as an undocumented immigrant.

Mishell Quintero, 23, works two jobs to help her five-person family make ends meet. At J.C. Penney, she works as a cash room clerk four days a week, which involves sorting and depositing the retailer’s money and fixing cash register malfunctions. She also works as a private caregiver for a paraplegic individual in the area.

Because the work in both fields is oftentimes tedious, Quintero said she wishes she could work for a better paying job that would give her the time and money to get a bachelor’s degree.

After Quintero’s mother illegally crossed over the border through Arizona, she, then 7 years old, and her younger sister hid in the backseat of her uncle’s car as he used fake papers to transport them across. Her parents had extended family in Springdale, so they immediately moved to the area and have remained since.

“My parents didn’t lie to me. They didn’t say that I did have papers here, but they never told me that I didn’t have papers,” Quintero said. “I was never worried about having to have a job until I was 18 or never having to drive until I was 18 because they were always like, ‘You’re not going to do anything until you turn 18.'”

After turning 18, she began searching for jobs to help support her family. That’s when reality hit: she wasn’t a legal resident of the country. Quintero is a Dreamer, meaning she qualifies for and takes advantage of the Development, Relief, and Education for Alien Minors (DREAM) Act. The topic of illegal immigrants’ children receiving certain benefits afforded to citizens who were born in America has been a political debate on a national scale.

She applied for and was granted a work permit, but she said she was scared of what employers might think.

(brief introduction needed for this clip)

At J.C. Penney, Quintero makes $9.50 an hour part time. In her role as a caregiver, she makes $15 an hour. With that money, she splits the cost of a mortgage, rent, food, utilities and car insurance with her mother, father and younger sister.

There are times when the family gets so tied up in paying bills that they eat at food pantries and soup kitchens. In the end, Quintero wants to attain citizenship so she can get a higher-paying job and eventually live her version of the American dream.

Carlos Morgan, Barber. By Aubry Tucker

Carlos Morgan works as a barber at Cut Close Barbershop, in Fayetteville, Arkansas. One of his biggest hopes is to be able to leave something behind for his kids, “…to own something, to leave something for my children…I don’t have any want to buy a brand new car or nothing, that’s not a dream.” Photo by Aubry Tucker.

Carlos Morgan works as a barber at Cut Close Barbershop, in Fayetteville, Arkansas. One of his biggest hopes is to be able to leave something behind for his kids, “…to own something, to leave something for my children…I don’t have any want to buy a brand new car or nothing, that’s not a dream.” Photo by Aubry Tucker.

Carlos Morgan, 32, was born in Tennessee, but said he grew up in California, before he found his home in Northwest Arkansas. He has been cutting hair for 14 years and started out cutting his own hair before he learned professionally. He said after filing his taxes for 2017 that he made about $26,000, and estimated that he was making about $10 an hour at his job. He takes one day off a week and usually works from 9:30 a.m. to 6:30 p.m. Morgan said he shares the custody of his children, one of whom is a basketball player at Fayetteville High School, graduating this year.

Morgan’s most expensive bill is his rent which is costing him more than $1,000 a month for a three–bedroom apartment, a cost he pays alone. Morgan said most of his money goes to bills and that he doesn’t spend money on frivolous things. Next year Morgan said he wants to buy a house, and one day a barbershop of his own. Morgan described his childhood as “pretty rough,” and even, “cliche,” of a black man growing up. “Pretty much cliche, mother did what she did, father was in jail, things like that,” he said. He said he has three siblings, two of whom are incarcerated, and another that he doesn’t keep in touch with.

Morgan takes pride in his work, “a haircut is more than just a haircut,” he said, because it changes the way that someone feels about themselves. His client, Stanley Chukwuanu, 24, chimed in to add how special he is to him and the relationship they’ve developed through many years of knowing each other as barber and customer. Chukwuanu said he takes advice from Morgan, talks to him about his relationship, and that they always joke around with each other. Chukwuanu said he plans to move to Oklahoma City soon and doesn’t know who he’ll be able to trust with his hair there. Morgan said he works with different people everyday from an array of ethnicities. Several of Morgan’s clients have been coming to him for many years, and two more young gentlemen in the shop said they have been coming to Morgan for haircuts since they were kids.

Alvin Davis, Engineer. By Katie Serrano

Three years ago, Alvin Davis was an engineer. He had a steady job, one he was proud of and worked hard for.

But people who have professional training can fall into poverty or become homeless because of unfortunate circumstances, he said on April 8 at Fayetteville’s first “Walk a Mile in My Shoes” march, organized by University of Arkansas senior Quinn Childress. A little over 100 individuals marched from 7hills Homeless Center to the Fayetteville Town Center

Davis, a Fayetteville native, is one of those people. After being laid off, his bills quickly began to pile up and he lost his car, then lost everything.

Although Davis lives at the 7Hills Walker Family Residential Community, which provides transitional and permanent supportive housing, nobody wants to hire someone who’s address has the words “7Hills Homeless Center” in it, he said.

In order for homeless individuals to have an actual address, they have to have a wage that will allow them to pay for rent.

“We need to raise the minimum wage, because rent won’t wait,” he said. “Local companies abuse the homeless, knowing that they will work for almost nothing because they are in need of almost everything. But that isn’t going to help solve the problem.”

Davis addresses a crowd in the square at the Fayetteville Town Center on Sunday April 8.

“Let’s say you’re lucky enough to find affordable housing or apply for a housing program,” he said. “You’re still not going to get it because then you have the background checks, and you could have a non-violent charge against you that happened 20 years ago, and you’re still not gonna get the apartment.”

Housing owners and apartment tenants need to reduce the price, he said.

“We’re not even given the opportunity,” Davis said. “But people don’t care. I walk everywhere, there are vacant houses everywhere. There are help wanted signs everywhere. I know so many carpenters and plumbers who are not being utilized, or if they are it’s nowhere near a liveable wage.”

Nicholas Pando, sitting on his desk stool, focuses hard on explaining how his favorite game, Magic, is played.

Nicholas Pando, sitting on his desk stool, focuses hard on explaining how his favorite game, Magic, is played.