Agenda for Monday, Oct. 8

–Context!

–Common Errors

Context #1

Add the Quick Facts for city population, demographics.

Little Rock: African American comprise 42 percent of Little Rock’s population. https://www.census.gov/quickfacts/fact/table/littlerockcityarkansas,US/PST045217

Add typical salary from Occupational Employment Statistics database for Arkansas

https://www.bls.gov/oes/current/oes_ar.htm

Common Errors – Math

Percent vs Percentage Point

At Lyon College, 67 percent of non-first-generation students paid back their loans within five years, while only 53 percent of first-generation students did the same, which results in a 14 percent POINT difference. The median debt for both types of students was the same though, at $12,000.

You mean “percentage point.” 14 percent of 67 is 9.4.

Steve Doig – MathCrib-Doig

Common Errors – AP Style on Numbers

AP Style on Numerals:

Numerals – AP Stylebook-2avrxtn

Common Error – Divi Library

Divi Builder. Do Not Save to Library.

Context #2: Build Charts for Context

First row: The overall median debt for Arkansas students; for men, for women.

Second row: The overall median debt for first generation students. And non-first generation

Third row: The overall statewide repayment rate, and the rate for men, for women

Fourth row: The overall median debt for white, black, asian, hispanic

Post on WordPress with the category Context

Research – Data Question

The Financial Aid department does not report loan repayment info to the Department of Education. “Once the students leave us we don’t track their information anymore,” he said.

Question: Look at data dictionary for source of this information. All 1,826 columns explained here.

https://collegescorecard.ed.gov/assets/FullDataDocumentation.pdf

https://collegescorecard.ed.gov/assets/CollegeScorecardDataDictionary.xlsx

Homework

#1: Read this report and compare to your work on context. Prepare to discuss it Wednesday

https://ticas.org/sites/default/files/pub_files/classof2016.pdf

#2: By 11:59 p.m. Tuesday, fix the issues with your charts and stories from Assignment #2. Post on WordPress, use the Context category for a tag

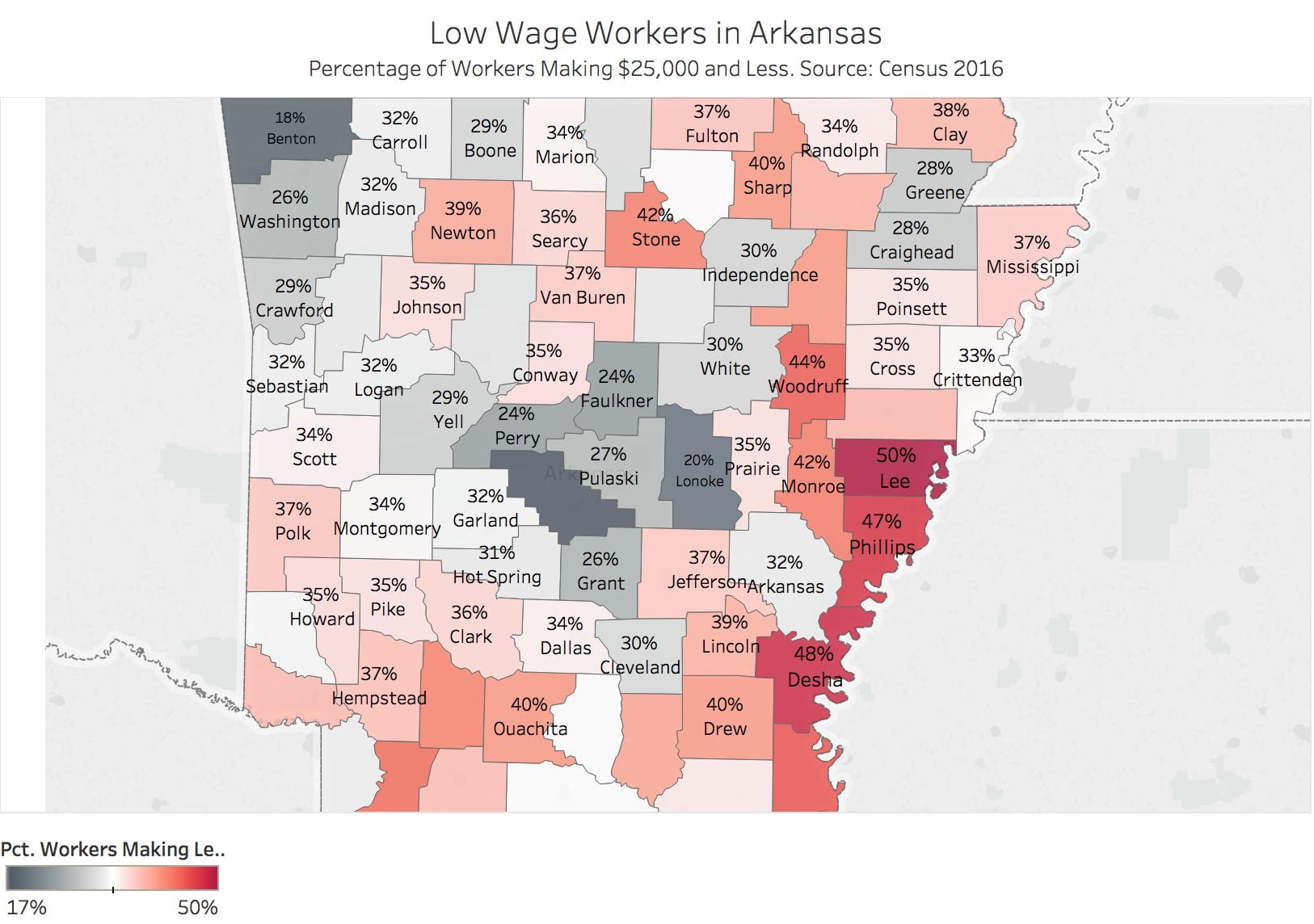

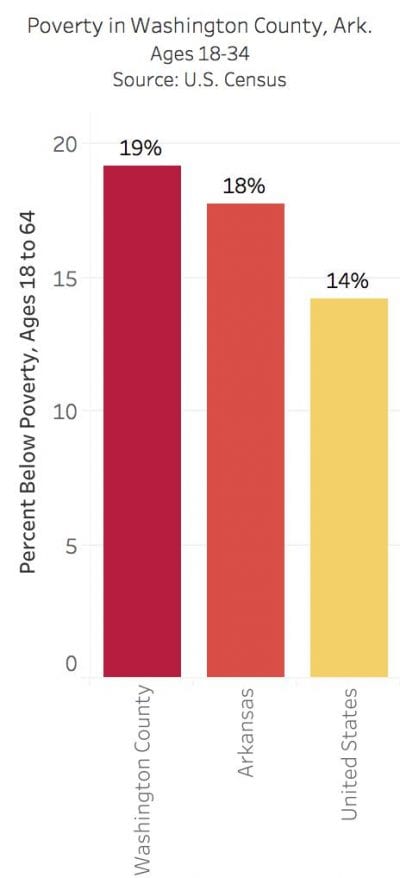

Working and Poor In Arkansas

WORKING, AND POOR, IN ARKANSAS

Class 11 – April 5

Assignment #4:

Advanced Reporting & Data Analysis

Jour 405V Sec. 7, Spring 2018

Assignment #4: Interviews

Due 11:59 p.m. Wednesday, March 28. Post on WordPress

Write a 500-word news story based on an interview with a person classified as working poor in Northwest Arkansas.

Consider diversity in race and occupations when selecting your interview subject.

Illustrate this post with the following:

-

- A photo of your interview subject. Pay attention to background, lighting and composition.

- Use a professional Zoom recorder to gather and produce a 30-second – maximum 2 minute audio clip from your interview. Introduce your subject and the context of the interview, like you would hear on a podcast. Gather background or ambient sound of the workplace. Mix this and embed this in the blog post.

Additional Material for Graduate Students:

Interview a second person, meaning you are interviewing two people in total. The second interview has a photo and an audio clip, as described above. No graphics needed for the second interview.

Everyone:

Post the interview, graphic and photo in a single blog post, weaving them together to tell the story of your interview subject. Follow a news story format and follow AP style. This is due 11:59 p.m. Wednesday, April 11. Post on WordPress

Assignment #5. Final Production of Stories. Due May 3.

Complete the punch list of tasks to improve stories, photos, graphics; make revisions based on editing.

Assignments will be on the “Punch List” post on the class blog beginning April 5. This list will be updated weekly as we enter final production.

Participate in design and production of website for final class project. Work in teams if so assigned.

Organize Our Project

Feedback

Bobby Ampezzan

Fact Check

Attached is a spreadsheet for the fact checking process. Please put the name, email and phone number of the people you spoke to on this list. I will be contacting them and sending a few quotes to make sure everything is ok. I do this on major projects and rarely have any issues – the people we interview really appreciate the follow-up.

Editing Punch List

Andrew Epperson and Philip Sais audio.

–Question for Epperson on the Sais graphic – bar musicians

–re-edit the photo and crop it tighter

Ann Johnson, Chris Paff

–edit graphic, eliminate legend – measure names.

–update data for 2017.

Mary Kerr

–bring in the audio files, fix audio for Cathy Lee

Katie Serrano

1) Dana Ralpho

–Wage she earns at Wendy’s

–Audio clip

–More detail about her situation. This story is very brief and incomplete

2) Renee Smith

–increase in pay reference – what was that? explain

–Audio still doesn’t work.

–Photo needs cropping

–Fix graphic. Just display average annual wage

Elisabeth Butler

Abigail Jobst: Not sure where she is working (Grubs?), how much she making and if they remain in poverty status if Zeballos is back to work making $50,000?

Finished Drafts So Far

Return of R Studio

Today’s set of tasks:

Data

US Ark Counties Poverty ACS_16_5YR_DP03-Jan 24-y46vv7

Race Poverty Set

ACS_16_5YR_S1701_with_ann-28nvp6q

File Header Definitions

Readings

Read / Listen:

https://www.thisamericanlife.org/extras/our-town-the-economists-report

Finish Nickel and Dimed

Renee Smith, Burger King. By Katie Serrano

When Renee Smith, 43, comes into work at Burger King every day, she takes pride in working her way up from getting paid $8.50 an hour to $11 an hour.

As a mother of four children and one grandchild all under the same roof, Smith said her and her husband have struggled to make ends meet for years.

“I’ve been working here for four years,” she said. “When you’re in a place long enough, you get comfortable and it’s hard to leave.”

Smith’s husband is a farmer, and she said they have to rely on their oldest daughter to help support them.

“We are surviving,” she said. We are nowhere near where I want to be.”

When it comes to budgeting, Smith and her family focus on putting food on the table.

“I wish we got coupons or something working on here, that would be a life saver,” she said. “But food is what we got to use our paychecks for first. I’ll get my hair and nails done when I can to look nice or splurge on the girls and buy them a new pair of shoes, but that’s about it.”

Smith has been working at Burger King for four years and said the increase in pay is not cutting it.

“They say that they’ve increased the minimum wage ‘this’ much percent every year, but it does not make a difference,” Smith said. “I’ve worked here four years and have barely made a three dollar increase. It is by no means a liveable wage.”

Dana Ralpho, Wendy’s. By Katie Serrano

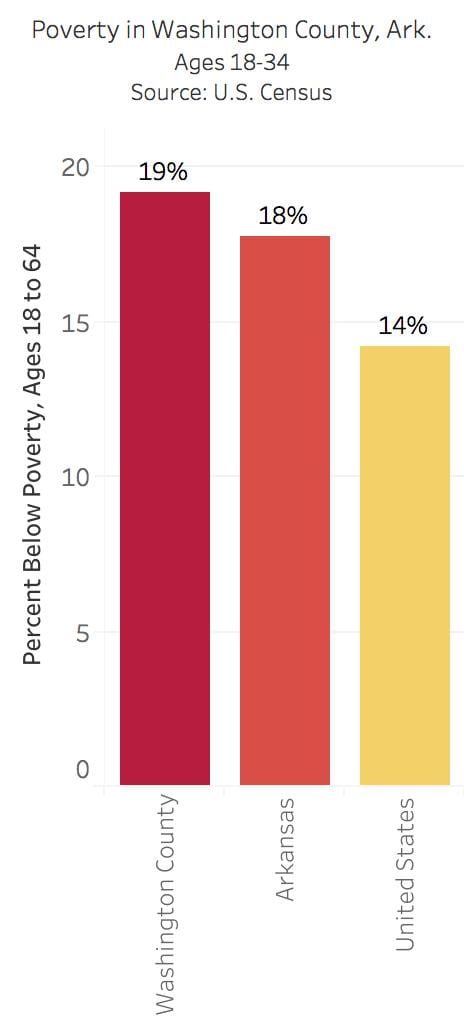

Poverty in Arkansas ranges from 18 year olds to the elderly, and Dana Ralpho feels the burden of supporting her family at only 18 years old.

“I’m considered a part time worker even though I basically have full time hours,” she said. “I work to support my family when I’m not at school.”

“My father is disabled so we’ve all had to work a lot longer hours,” Ralpho said. “My older sisters work at Walmart and Sam’s club to help out while my mother works at Mexican Original in Springdale.”

Ralpho is enlisted in the Navy and will be deployed at the end of June after graduating from Fayetteville High School.

“Joining the Navy will help take a financial burden off of my family, and I won’t have to worry about them as much when I’m gone compared to if I went to a University,” she said.

Version 2

FAYETTEVILLE, Ark. — At 18 years old, Dana Ralpho feels the burden of supporting her family.

“I’m considered a part time worker even though I basically have full time hours,” she said. “I work to support my family when I’m not at school.”

Ralpho has been working at Wendy’s for two years and now makes $9 an hour. She is enlisted in the Navy and will be deployed at the end of June after graduating from Fayetteville High School.

“Joining the Navy will help take a financial burden off of my family, and I won’t have to worry about them as much when I’m gone compared to if I went to a university,” she said.

“My father is disabled so we’ve all had to work a lot longer hours,” Ralpho said. “My older sisters work at the call center at the Sam’s club in Springdale to help out while my mother works at Mexican Original in Fayetteville.”

Class 10: March 29

Today’s set of tasks:

Data

US Ark Counties Poverty ACS_16_5YR_DP03-Jan 24-y46vv7

Race Poverty Set

ACS_16_5YR_S1701_with_ann-28nvp6q

File Header Definitions

Return of R Studio

Today’s set of tasks:

Data

US Ark Counties Poverty ACS_16_5YR_DP03-Jan 24-y46vv7

Race Poverty Set

ACS_16_5YR_S1701_with_ann-28nvp6q

File Header Definitions

ACS_16_5YR_S1701_metadata-1on99rr

Homework

Read / Listen:

https://www.thisamericanlife.org/extras/our-town-the-economists-report

Finish Nickel and Dimed

Send in revisions to Assignment #3 to WordPress by 11:59 pm Wednesday, April 4

Phillip Sais, Bar Musician. By Andrew Epperson

Phillip Sais stands outside dueling piano bar Willy D’s on March 27. Credit: Andrew Epperson (crop photo to bring Sais in closer)

Financial support from parents is a key element of many UofA students’ educational and professional success. For one former student, a fight resulted in an introduction to self–reliance and a realization of needed frugality to make ends meet.

Phillip Sais, 21, was born in India before he was adopted by parents in Arkansas when he was 1 1/2 years old. Shortly after he began attending college, he and his parents got into an argument that resulted in an agreement that seemed simple at the time: he’d pay for his own responsibilities, including rent, utilities, food, school and lifestyle. Essentially, he was off his parents’ payroll.

An avid musician from a young age, something he picked up from his mother, Sais turned to searching for a job in one of the many scenes in Fayetteville to make ends meet. He searched “dueling piano bars” and found an establishment named Willy D’s. He was worried about potentially being turned down because his age was under the drinking limit at the time, he said. Despite his doubts, he was offered a tryout and ultimately a role as a runner and pianist.

“It was scary going around on Dickson Street and asking for a job,” Sais said. He was under the legal drinking age, and the prospect of playing music around intoxicated patrons frightened him. “It was so scary, but I did it, and I absolutely love the job.”

As Sais continued to become more comfortable to his role, a problem with his handling of student loans put him in a situation where he needed to take out more loans to pay off old ones, so he was left with no choice but to drop out of college with less than a year remaining before he’d get his degree. Still, he’s paying off student loans in an attempt to open up his budget to take on the expenses of more loans once he enrolls again.

As of March 28, Sais’ weekly schedule goes from 8 p.m. to 2 a.m. Thursday, Friday and Saturday. The hourly salary for a musician in an employer listed under “Drinking Places (Alcoholic Beverages)” on the Bureau of Labor Statistics’ employment data was $24.09 in 2016. (SHOW THIS TO ME) Based of his schedule, when calculated on a yearly scale, his yearly salary is around $22,548.24, which hovers around the median income for workers of much-less specialized jobs.

–Question for Epperson on the Sais graphic – bar musicians. where did you find that data?

Sais purchased a motorized scooter to get from place to place in the area, as gas prices and car insurance made it unfeasible for him to purchase a four-wheeled vehicle. He pays a “roadie fee” to his friends who have cars and can help him transfer his equipment from gig to gig.

During football season, business booms and Sais sees an increased number of tips. During the summer, on the other hand, the lack of students and fans coming to Dickson Street makes business a little tougher to come by. During a really tight period, Sais was forced to resort to asking his family for money, he said.

“[To stay afloat,] you have to be willing to do what it takes to make ends meet, even asking family for money sometimes,” Sais said. “The important thing is to never stop, never stop working, and make sure you’re willing to do what it takes to earn an adequate living.”

In the future, Sais plans to enroll in school again to finish his bachelors degree in music performance, he said. If everything works out economically, he will continue working at Willy D’s while attending classes.

Chris Pfaff, EZ Mart. By Ann Claire Johnson

FAYETTEVILLE, Ark .— Chris Pfaff, 38 years old, is a clerk at the EZ Mart in the Shell gas station on Martin Luther King Blvd. Pfaff is working but he is currently homeless. He grew up in Pennsylvania and moved to Arkansas after dropping out of high school his senior year Pfaff is aware that he does not need a high school diploma or a GED to get a job, but he is actively trying to complete his GED test by utilizing the internet and practicing test-like questions in his spare time.

Chris Pfaff is currently living out of a tent, and has been for nearly two months. “It’s not easy. You have to fight everyday to try to get a shower, you have to fight every day to try to get your laundry done, along with everything else,” Pfaff said. He made it clear that he does not let the current quality of his life affect his mood or attitude about life when he comes into work on a daily or nightly basis. “I come in every day with my head up high,” he said.

He makes an hourly wage of $8.50 and his responsibilities include stocking the coolers, making sure the coffee is hot and fresh for the customers, keeping the floors are cleaned and mopped, working the cash register, and making sure the bathrooms are cleaned. Although he does not have a problem going to work with a smile on his face, he admitted that sometimes the light at the end of the tunnel, representing stability and peace, is further away some days even if it seemed easy to reach the day before. “Some days it feels like a long stretch to get to the end of that tunnel,” he said.

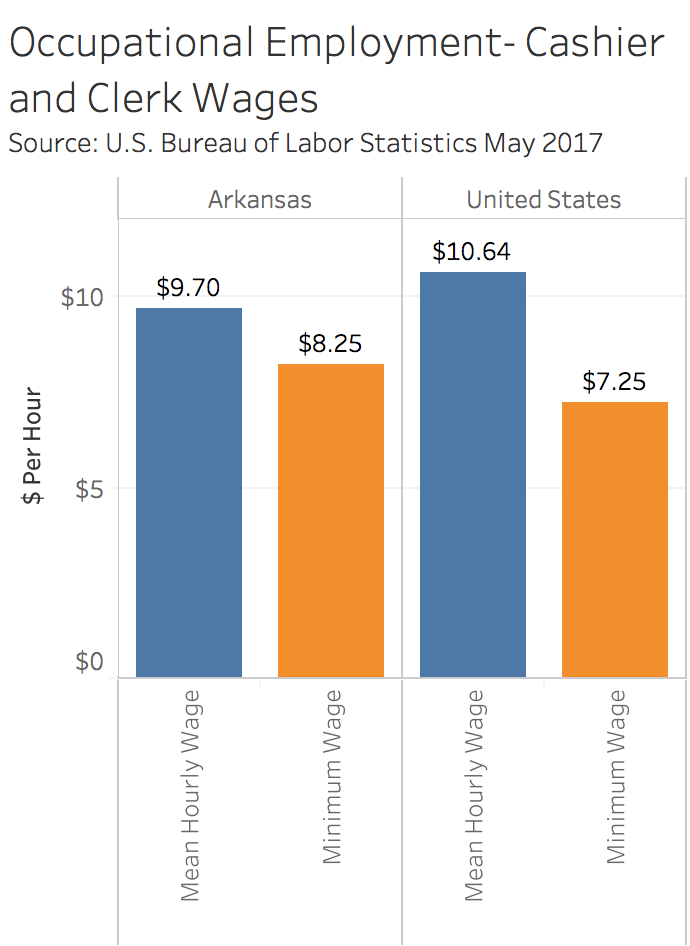

This graph shows that cashier and clerk wages vary very little on average, no matter where one works in the United States. Occupational employees, specifically clerk and cashier workers, have hourly wages that rise $3 above minimum wage on average in the United States. This puts and keeps workers, like Chris Pfaff, below the poverty line if they depend on this single job for income.

Pfaff gets to and from his job by driving his truck. “I slept in my truck for over a month one time. It’s not very comfortable,” he said. Prior to working at the EZ Mart, he worked at McDonalds as a griller and at Tyson but had to stop after developing Carpal Tunnel Syndrome in his right wrist. This resulted in him seeking a less physically demanding job at the EZ Mart.

Pfaff believes that Fayetteville could improve the living conditions for the homeless community by providing more subsidized housing that does not include an extra utility bill to pay. “Not everyone can afford to pay the electric bill on top of our other living expenses,” Pfaff said.

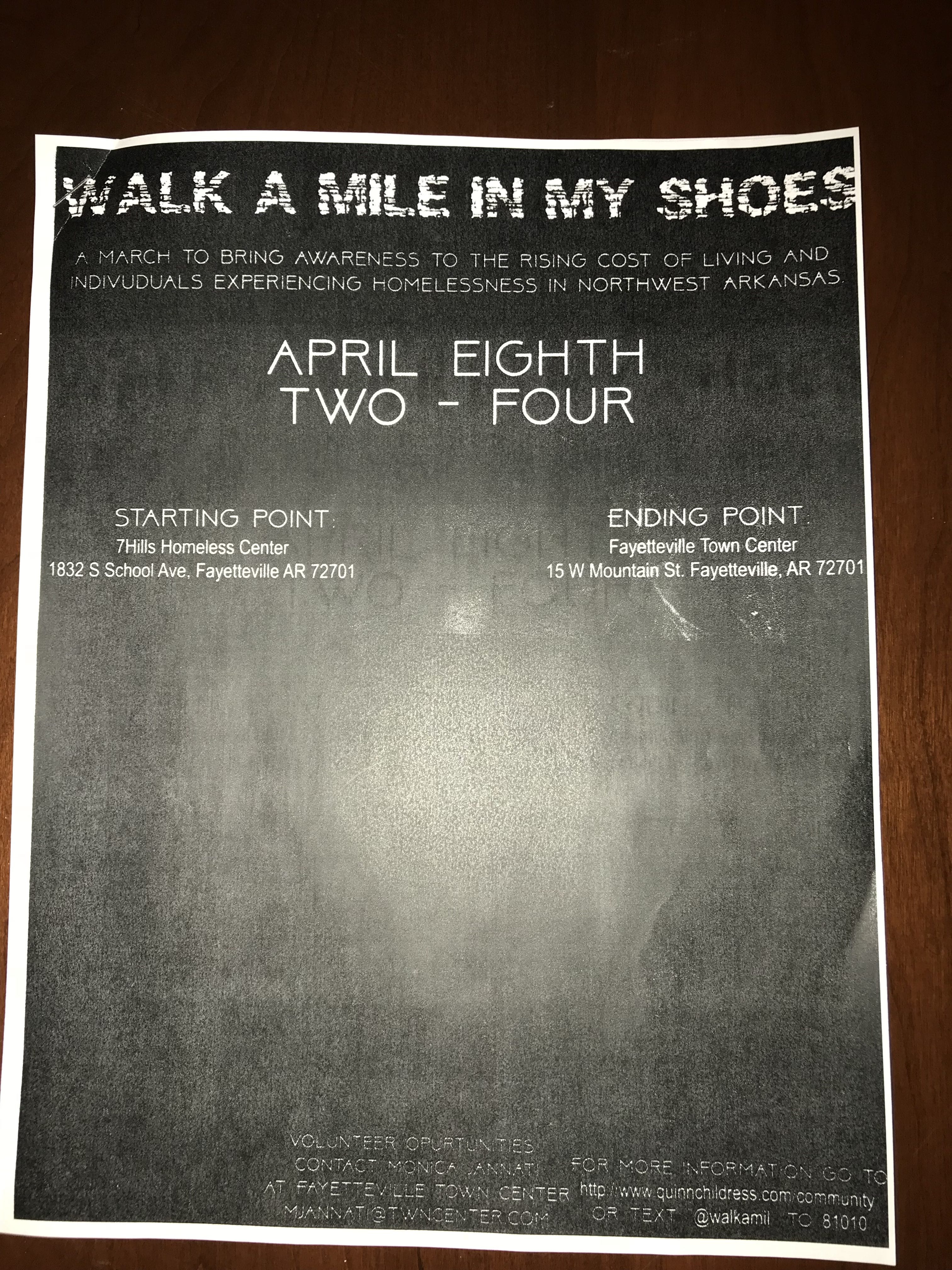

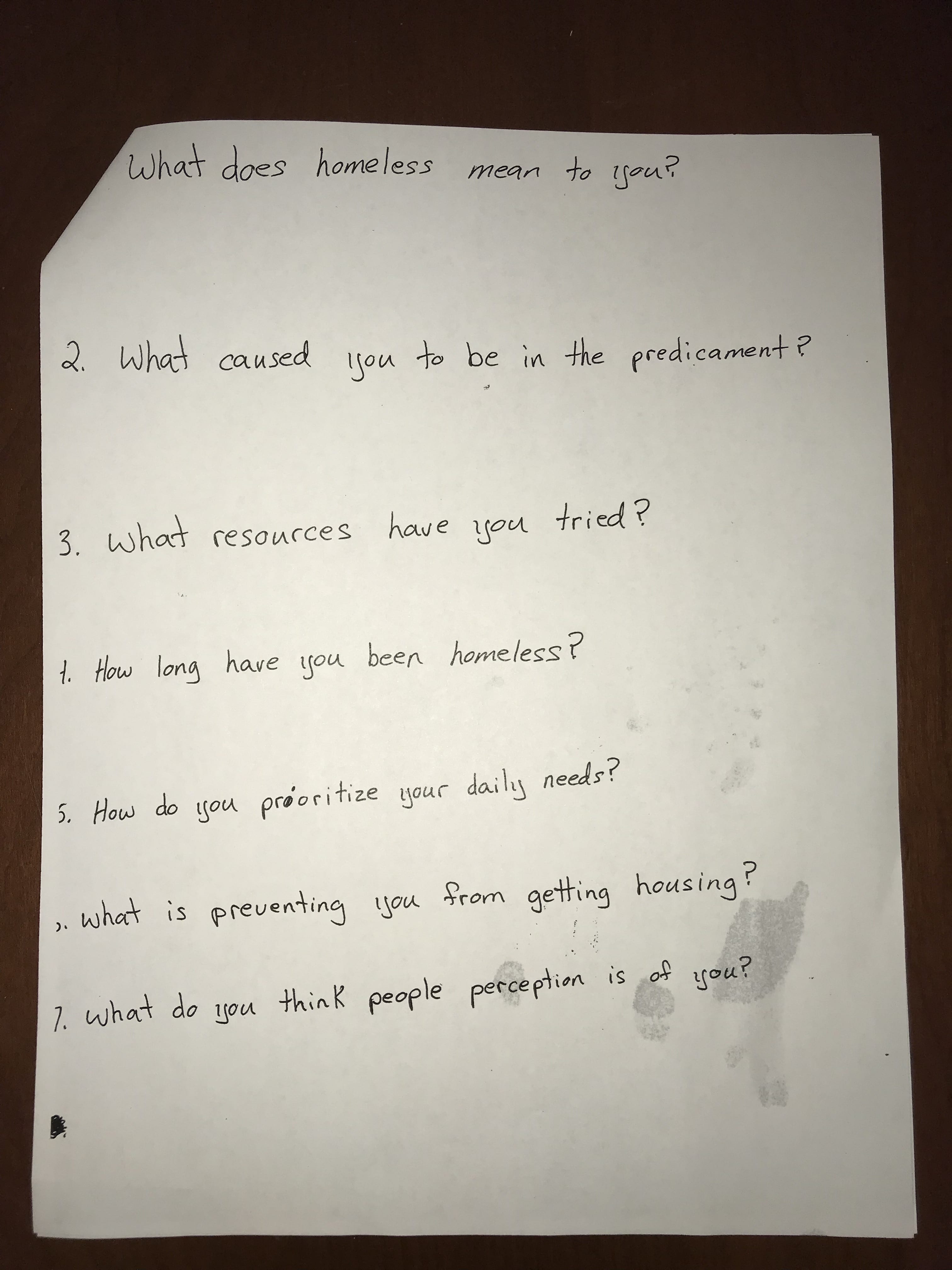

Pfaff and his coworker have been passing out flyers for Walk a Mile in My Shoes, which is a “march to bring awareness to the rising cost of living and individuals experiencing homelessness in Northwest Arkansas”, taking place on April 8th. Attached to this flyer is a questionnaire asking the participants to answer seven questions about their opinions and experience on observing or being part of the homeless community.

Chris Pfaff’s contact information:

(240) 452-2215

devilman0979@gmail.com

Cathy Lee, Chuck E. Cheese. By Mary Kerr Winters

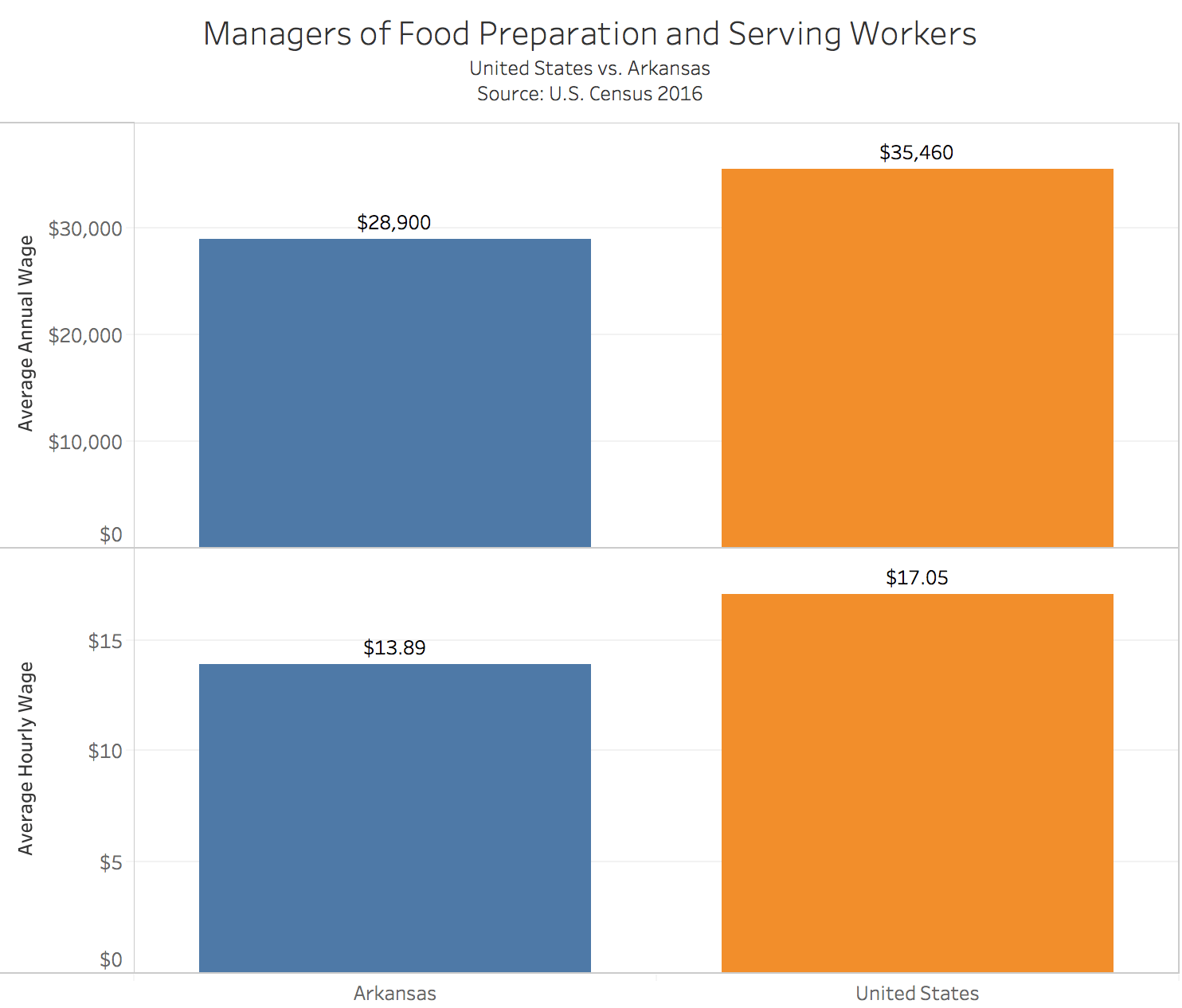

FAYETTEVILLE, Ark. – Wearing a fiery red lanyard with “Manager” boldly written in white, Cathy Lee, 23, expresses her pride and contentment with her managerial position at Chuck E. Cheese while getting paid only $11 an hour.

Lee is originally from California, but moved here almost 15 years ago because of her father’s desire to farm in Northwest Arkansas. Lee said she didn’t really mind the move because she was only 7 years old at the time.

Many opportunities arise through connections of friends and family in this specific work force. Lee said she has worked at other places in Fayetteville including Walmart, but when her friend offered her a manager position at Chuck E. Cheese, she immediately took the job.

When asked what most of her money was spent on, instead of saying the common expected areas like rent, she said, “food and most of all things I like to do for fun.” This included going out with friends for a drink, video games and seeing drive-in movies.

She works hard, 40 hours a week, so she can do the things that she loves the most, which is spending time with friends and her partner, Kelly.

Lee said, “this location is the least busy out of the three in Northwest Arkansas,” which can be the worst part of the job sometimes. However, she also said that her coworkers and the people make up for the annoying parts of her job, which Lee laughingly explained were the occasional boring hours.

When asked about her favorite memories growing up, Lee said, “One of my favorite childhood memories was definitely hanging out with my cousins. We would just do dumb stuff; go swimming and look for cod fish.” Lee values her friends and family most in her life, and wants to spend her life enjoying every moment she gets to do so.

Cathy Lee Clip

Assignment #3 Katie Serrano

When Renee Smith, 43, comes into work at Burger King every day, she takes pride in working her way up from getting paid $8.50 an hour to $11 an hour.

As a mother of four children and one grandchild all under the same roof, Smith said her and her husband have struggled to make ends meet for years.

“I’ve been working here for four years,” she said. “When you’re in a place long enough, you get comfortable and it’s hard to leave.”

Smith’s husband is a farmer, and she said they have to rely on their oldest daughter to help support them.

“We are surviving,” she said. We are nowhere near where I want to be.”

When it comes to budgeting, Smith and her family focus on putting food on the table.

(AUDIO DOES NOT PLAY. Need to fix this)

“I wish we got coupons or something working on here, that would be a life saver,” she said. “But food is what we got to use our paychecks for first. I’ll get my hair and nails done when I can to look nice or splurge on the girls and buy them a new pair of shoes, but that’s about it.”

Butler – Assignment 3

PHOTO SEEMS OUT OF FOCUS.

Style errors in red

My comments in green

Working with children is more than feeding, changing, bathing, and entertaining them. For Hannah Pelton, a junior at the University of Arkansas, it pays the bills. (We discussed at the beginning of the semester that we wouldn’t interview students of Univ of Arkansas. They aren’t a good representation of the working poor. So I have a problem with this selection from the start) Mostly.

Pelton began working at the Boys and Girls Club in Fayetteville in January of 2017. The hours and pay (HOW MUCH IS SHE PAID?) were good, and gave her time to do her homework. Her previous job at the Hallmark Store in the Northwest Arkansas Mall caused her grades to slip and her motivation to dwindle.

“I had to be a student first,” Pelton said, “that’s why I’m here”.

Pelton works most days at the Boys and Girls club supervising children, playing games with them, helping them get their homework done, and talking about their problems with them. But the job isn’t always Monday-Friday. She spends some Saturday mornings at basketball games for a little boy, (WHO?) or buying Girl Scout Cookies from a girl who just needs one more box.

Officially, the Boys and Girls club is closed on the weekends, giving Pelton most Saturdays and Sundays to have the traditional college experience. The University of Arkansas is the school she always planned on going to, but not at a low cost. At the end of undergrad, Pelton will owe close to $80,000 in student loan debt.

Pelton is also a Communications Disorders student, pursuing a career in speech therapy. Graduate school is professionally required to get a job after graduation for rising speech therapists. An extra set of letters at the end of your name adds greater potential in the professional world, but an extra set of dollar signs out of your bank account shrinks yearly earnings in the long run.

When she decided to go to the University of Arkansas, Pelton’s parents responded with a comment of how great her student loan debt will be. They pay for her car insurance and gas, but that’s it.

Pelton uses her minimum wage salary (NEED TO SPECIFY) to pay for rent and groceries, and other expenses that may come up. Having the traditional college students these days is expensive. Students spend thousands of dollars a year on spring break, concert tickets, and having the newest pair of tennis shoes. (THIS IS OUT OF SYNC WITH THE WORKING POOR FOCUS OF THIS CLASS) She is often left out of trips and events because she is working or must buy groceries for the upcoming week.

Working a minimum wage job has taught Pelton crucial skills about budgeting and how to prioritize daily activities.

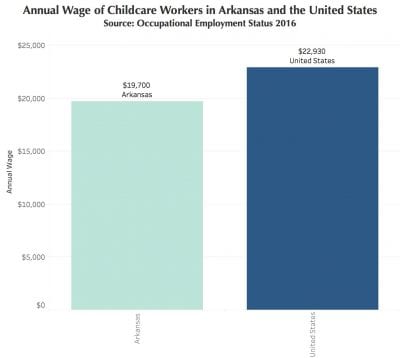

The Occupational Employment Statistics shows that over 7,000 people are employed as childcare workers in the state of Arkansas. It is a minimum wage job, earning less than $20,000 each year.

Most of the people Pelton works with are also college students, struggling to make ends meet without the help of their parents. There are a few supervisors who “are college educated adults” who do this as a living, Pelton says.

Even though the job isn’t glamorous and often doesn’t pay the bills, it is rewarding.

“I don’t get paid enough,” Pelton says. “I do more good than I get paid for.