First Assignment Due Monday, Oct 10, 5 pm.

So far in class, we have examined the mortgage lending issue from several perspectives so far. In this assignment, you will write a 500 word news analysis article, supply two graphics and underlying data that addresses these questions:

What are some of the primary reasons for mortgage lending disparities in Northwestern Arkansas? For example, examine the income, debt levels described in the Home Mortgage Disclosure Act tables. For context, refer to the U.S. Census Data on median family income for racial groups.

The point of this assignment is to pull together the various strands of our classwork and present it in a coherent news article with some clean graphics.

You will be graded on:

Writing

—Use of Associated Press style, particularly with numbers and data.

—Analysis of the data and trends. Your work will be marked down if you merely describe what you find. I want you to suggest some conclusions or causes from the data. For this assignment, it is ok to use a strong editorial voice and offer your opinions and conclusions from your research.

Graphics:

—Produce graphics that clearly display trends, have correct labeling and attribution of the data. Remember that simplicity is your friend.

Data:

—Produce a spreadsheet with the data clearly labeled and attributed, by year. Your data sources should be explained.

You will upload the a 500 word news article in Microsoft Word, .txt or .rtf format. Papers submitted as PDFs or any other format will not be graded.

Supply two graphics in .jpeg format.

Supply underlying data in an Excel spreadsheet.

All of this is due on Blackboard by 5 pm Monday, Oct. 10.

This is one of your five assignments that count for 50% of your grade.

Announcements

Michelle LaRoche, WSJ Recruiter, Guest Speaker Here, Thursday, Oct 13.

Summary LaRoche Resume:

Experience

Editor, Development

The Wall Street Journal

August 2013 – Present (3 years 2 months)Greater New York City Area

Managing Editor, Real-Time Desks

Dow Jones

February 2012 – Present (4 years 8 months)Greater New York City Area

Editor, Training and Recruiting

Dow Jones Newswires

April 2008 – February 2012 (3 years 11 months)

Assistant Managing Editor, Dow Jones News Service

Dow Jones & Co. Inc.

August 2004 – March 2008 (3 years 8 months)

Director, Corporate Information Services

Dow Jones Newswires

February 2002 – August 2004 (2 years 7 months)

Education

University of New Hampshire

Bachelor of Arts (B.A.), English/Journalism

1991 – 1995

HOMEWORK From Monday, Oct. 3

Review Team Assignments

Team Analysis of Other HMDA Tables

Each Team:

1) Will Combine the Spreadsheets

2) Analyze the Breakdown By Race

3) Produce a Basic Excel Chart With The Finding

4) Post The Graphic and Text Describing Your Findings And Questions in A Blog Post.

Team #1: Reasons for Denials – Conventional and Government Loans

Flores, Messina, Lyster, Billmyre

AGGREGATE TABLE 8-1 and AGGREGATE TABLE 8-2:

REASONS FOR DENIAL OF APPLICATIONS FOR FHA, FSA/RHS, AND VA HOME-PURCHASE LOANS, 1- TO 4-FAMILY AND MANUFACTURED HOME DWELLINGS & REASONS FOR DENIAL OF APPLICATIONS FOR CONVENTIONAL HOME-PURCHASE LOANS, 1- TO 4-FAMILY AND MANUFACTURED HOME DWELLINGS, BY RACE,

2014-reasons-for-denials-conventionalha8-2

Team #2 Incomes of Applicants

Dobrin,Thomas, Taylor Pratt, Ball

AGGREGATE TABLE 5-1 & AGGREGATE TABLE 5-2.

DISPOSITION OF APPLICATIONS FOR FHA, FSA/RHS, AND VA HOME-PURCHASE LOANS, 1- TO 4-FAMILY AND MANUFACTURED HOME DWELLINGS, BY INCOME, RACE AND ETHNICITY OF APPLICANT, 2014. DISPOSITION OF APPLICATIONS FOR CONVENTIONAL HOME-PURCHASE LOANS, 1- TO 4-FAMILY AND MANUFACTURED HOME

2014_ha5-1-disposition-by-race-income

Team #3 Past HMDA Data, 2013 and 2010

Taylor Pray, Eley, Henry

Analyze the 2013 and 2010 for the AGGREGATE TABLE 4-1 and 4-2, DISPOSITION OF APPLICATIONS FOR CONVENTIONAL HOME-PURCHASE LOANS, 1- TO 4-FAMILY AND MANUFACTURED HOME DWELLINGS, BY RACE, ETHNICITY, GENDER AND INCOME OF APPLICANT, 2014

Team #4 Loans By Major Banks

Monk, Ward, Trupp

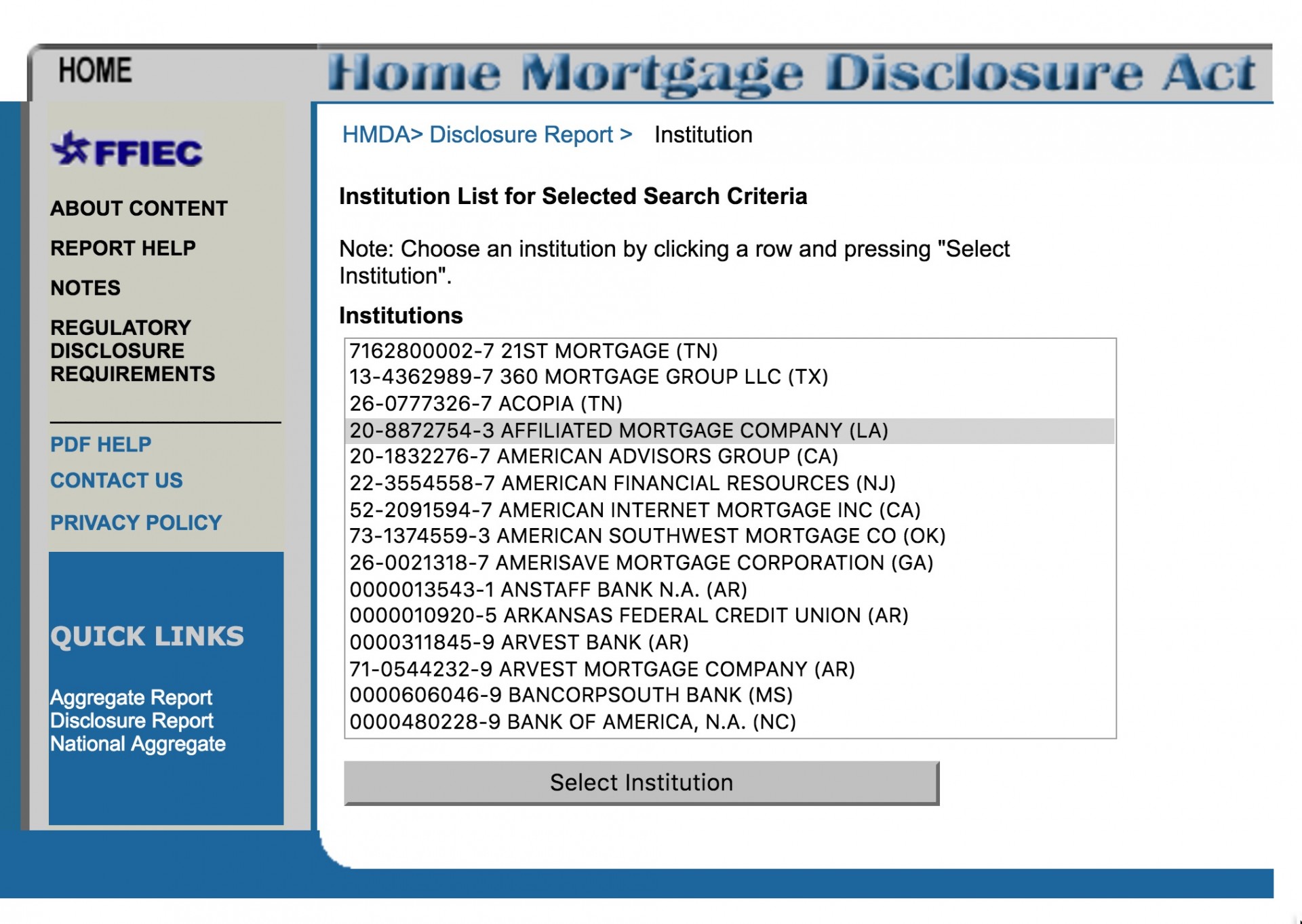

http://www.ffiec.gov/hmda/hmdaproducts.htm

–Disclosure Reports (by Institution), 1999 – 2014 HMDA

–Search by Loan Location

–INSTITUTION SEARCH BY LOAN LOCATION

–Arkansas, Fayetteville MSA

Search for Legacy Bank, First Security, Arvest Mortgage, Wells Fargo, Bank of America

INVESTIGATING THE BANKS

There’s an adventure involving researching

the individual banks and their lending records:

http://www.ffiec.gov/hmda/hmdaproducts.htm

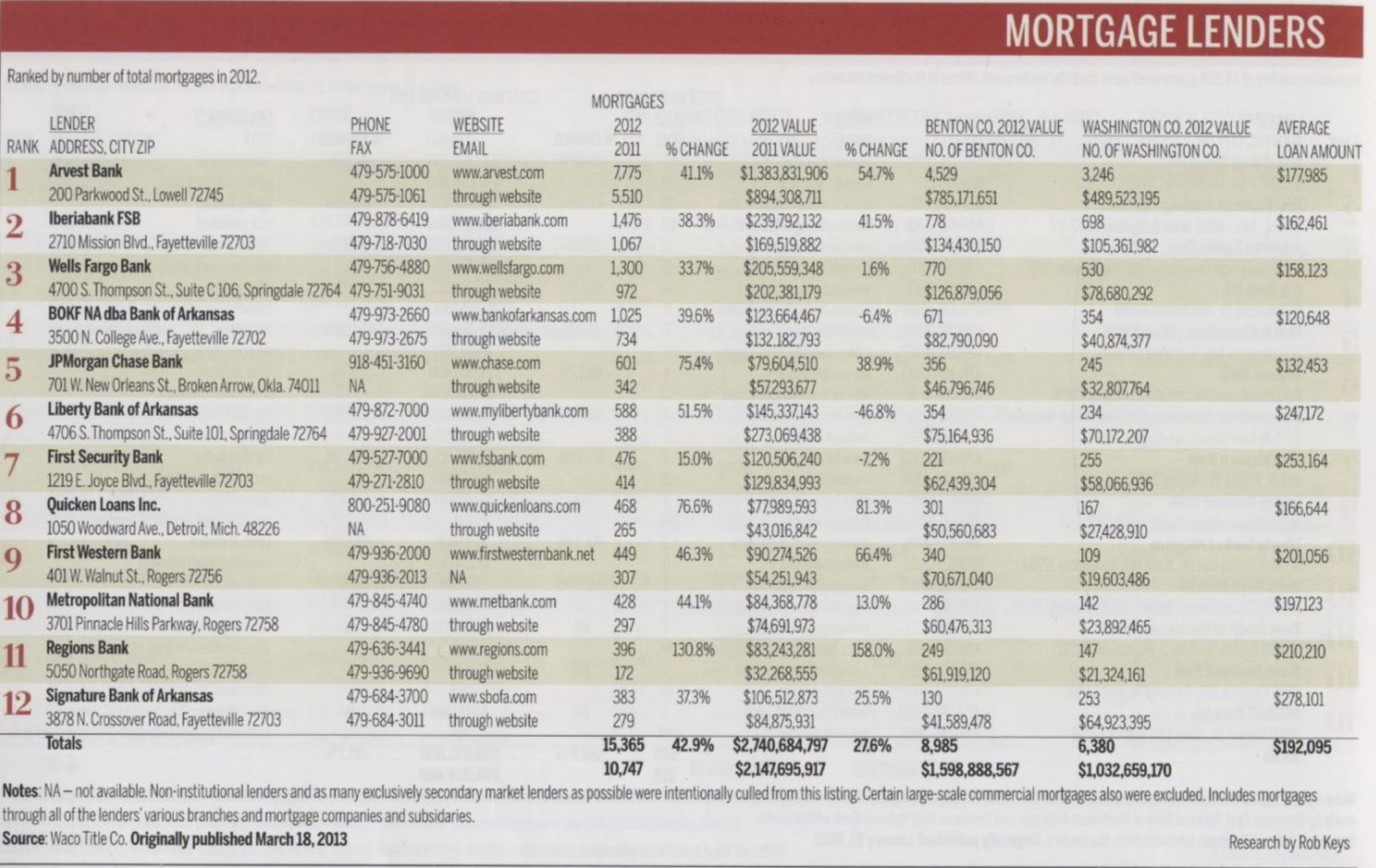

Who are the largest lenders in the region? 2013 Book of Lists, Northwest Arkansas Business Journal

- Cracking PDFs

2. Tabula Demonstration

3. It can get UGLY

Research the Banks, Part 1

Build a Spreadsheet from the 2013 Book of Lists, Northwest Arkansas Business Journal.

Use these fields: Rank/Lender/ City /2012 Mortgages /2011 Mortgages /% Change Number /2012 Value /2011 Value /% Change Value

Create New Calculated Field Determine the Total Marketshare of Each Bank for 2012

Produce a Data Visualization in Tableau or Excel on

#1 the Number of Mortgages

#2 the Amount of the Loans

#3 The Overall Marketshare

Post these graphics in your blog post by 11:59 PM WEDNESDAY OCT 5